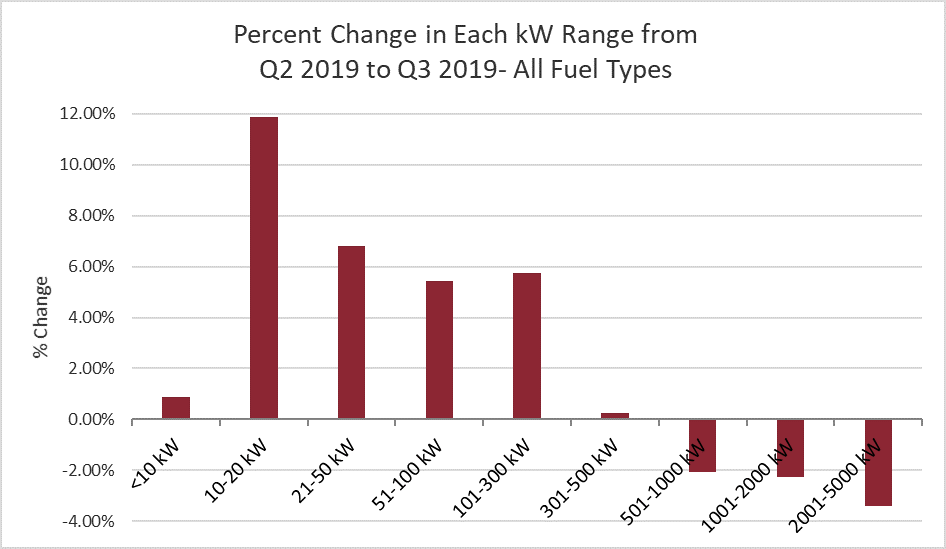

SUMMARY: Gen-set sales in Q3 2019 rose 7% from Q2 2019, due to a continued strong demand for standby power systems. Standby systems in both the residential and commercial sectors drove this growth (the highest QoQ growth of the year so far), with the 10-20kW range increasing sales by nearly 12% and the 21-50kW, 51-100, and 101-300kW ranges growing 5-7%.

Regular readers may remember that after the hurricane season of 2017, we predicted there would be a new baseline level of sales in the gen-set market and that the market would not experience a corrective crash after the shock of that particularly bad season wore off. Dealers explicitly confirmed that suspicion this quarter, stating that new clients, both younger and older than they were used to, were coming to them with the intention of being proactive about preparing for the upcoming winter season.

These new customers appeared to prefer natural gas gen-sets over diesel gen-sets, with diesel only growing 3% in the 10-20kW range and remaining flat or declining in all other ranges, while natural gas gen-set sales grew 8-10% in those 10-300kW ranges. On a Year-on-Year basis, overall unit sales for Q3 2019 were up 2.9%, compared to sales in Q3 2018.

The data comes from the proprietary PowerTrackerTM series of syndicated surveys conducted each quarter by Power Systems Research (PSR). A total of 1,400 interviews are completed each quarter with gen-set dealers and distributors, businesses and households across North America.

In the third quarter, several dealers told us they were seeing increased spending from customers who were looking to be prepared for winter storms. This is supported when looking at the historical QoQ sales growth for each power range in Q3.

In Q3 2017, we saw a huge spike in the sale of <10kW gen-sets. Over the last two years, however, we have seen sales growth in that power range drop precipitously, to about flat in Q3 2019. Those sales appear to have shifted primarily to the 10-20kW power range, which experienced a resurgence back to its high Q3 2017 level.

Commercial demand for standbys was also reported to be strong. As with the residential demand, commercial end-users appear to prefer natural gas. While the 101-300kW range more than doubled its typical third quarter growth with a nearly 6% expansion this year, diesel sales actually declined by 1% in that range. It was the almost 10% growth in natural gas sales in that range that drove the increase.

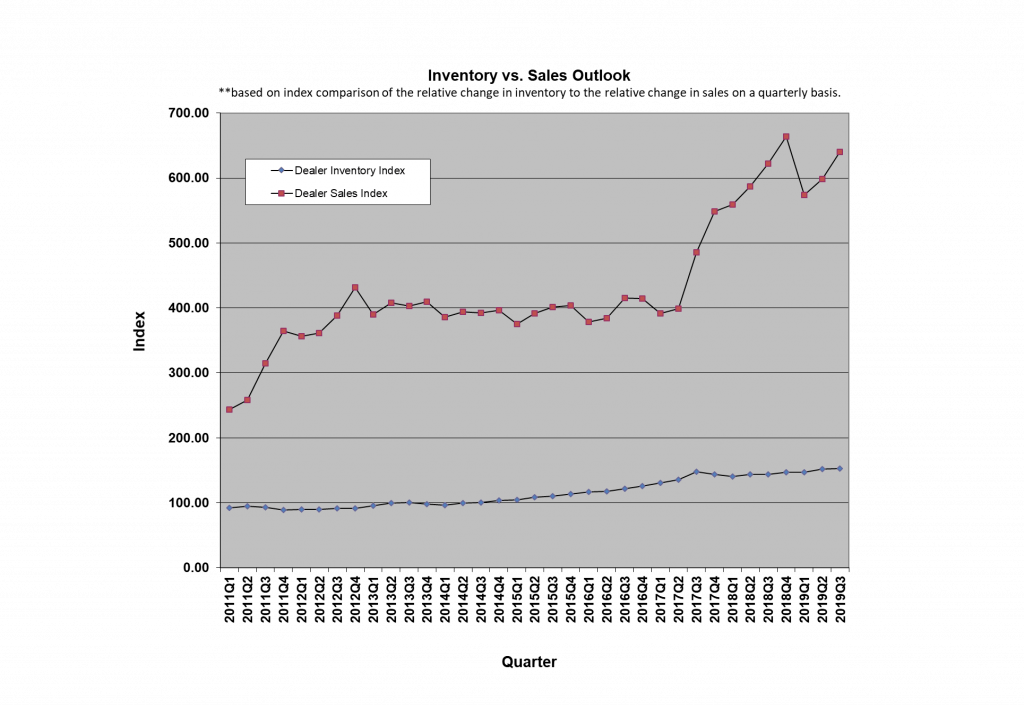

Dealer inventory levels rose 0.5% in Q3 2019 compared to the previous quarter, which is low QoQ growth compared to the third quarter in the past five years, beating only 2018 which experienced a very minor decline. This leaves inventories 6.1% higher than Q3 2018.

As part of our PowerTrackerTM series, we also monitor gen-set sales trends by application. Standby gen-set sales continue to be dominant, growing about 14% while portable sales were flat, and all other applications declined.

This marks the fifth consecutive third quarter with double-digit growth for standby sales. No other application has such a consistent pattern for third quarter sales, but cogeneration does stand out with its marked 7% decline in a time of year when it typically at least holds flat.

METHODOLOGY: Since 1998, Power Systems Research (PSR) has continuously maintained its PowerTrackerTM series of syndicated surveys, conducting 1,400 interviews each quarter among three key respondent groups in North America: gen-set dealers and distributors, businesses and households.

We conduct 200 interviews each quarter among dealers and distributors; the focus of this survey is on recent sales and market observations for the current quarter as well as expectations for the coming quarter.

Our Business Consumer survey consists of 900 interviews per quarter among a wide cross section of businesses to gather their input concerning ownership, usage trends and motivating factors for purchase, including any concerns about the reliability and availability of electric power.

Finally, our Household Consumer survey consists of 300 interviews per quarter to learn more about gen-set ownership trends among households and monitor the likelihood of a gen-set purchase.

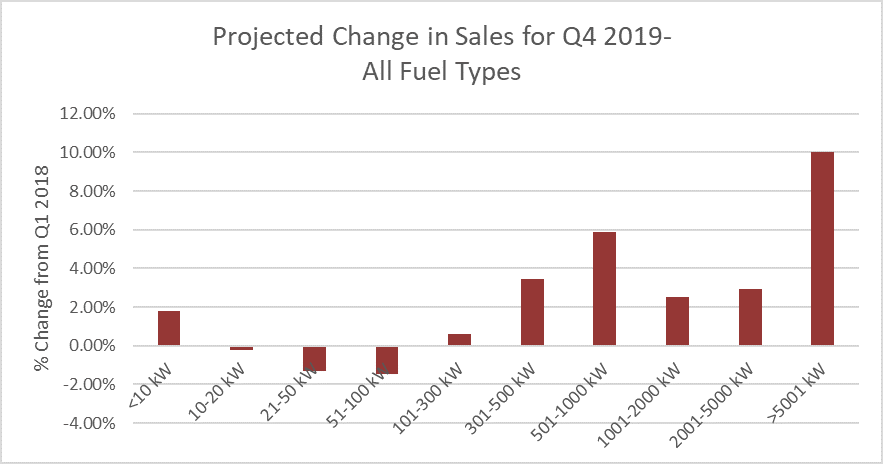

Dealer/Distributor Outlook for Q4 2019

At the same time, they offered an unusually positive forecast for the 301-500kW, 501kW-1MW, and 1MW-2MW ranges. They predict 2.5-6% growth in those ranges, demonstrating greater optimism about Q4 2019 in those ranges than for the same period in any of the last four years.

These positive expectations seem to be driven by optimism regarding diesel gen-set sales in the 301-500kW range and about natural gas in the 501-1MW and 1-2MW ranges. Dealers are expecting a low single-digit decline in natural gas sales in the 10-300kW ranges and a low single-digit gain in diesel sales in those same ranges.

When asked, “Why do you expect sales to change in the upcoming quarter?” comments from dealers focused on the following market observations:

- Severe Weather Season: Several dealers reported that consumers were being proactive about preparing for the coming winter season, whether that means hurricanes or severe cold. This is coupled with an increased demand for larger standby gen-sets. This all marks a shift from the pattern in previous years of rushing out to buy a portable gen-set after the storm hits.

- End of Summer: While some dealers were excited about the dawn of a new season and the purchase of necessity-generators that it would bring, others were lamenting the end of a season of sales for recreational gen-sets. As the last hardy campers succumbed to cooling temperatures and the end of tailgating season, dealers that rely on these types of sales were settling in for a quiet winter.

- Blackouts: A few dealers mentioned the PG&E planned blackouts in California that are intended to prevent wildfires. These efforts have so far failed to completely prevent wildfires, so we will watch to see how further expanded blackouts impact the power generation market. Given the widespread attribution of the wildfires to climate change by officials in the region, we will also be curious to see if California adopts even stricter emissions standards on generator sets. We aren’t aware of any proposals at this time, but it seems unlikely that a region concerned about climate change will allow the solution to their climate change-fueled wildfires be to adopt thousands of greenhouse gas-emitting generators.

When asked, “What changes have you recently noticed among particular customer groups or product categories within your market?” there were several comments that emerged as common themes. Many of these are comments that have carried from quarter to quarter, but the following is a sampling of some key observations:

- By and large, dealers reported a continuation of trends from the last quarter. Aside from the increased desire to be prepared for natural disasters, planned and unplanned power outages, and the consequent rise in whole-house generators, dealers report that the rise in residential demand is being accompanied by a shift in consumer demographics toward younger buyers.

- Consumers are increasingly drawn to technological advancements in their power generation. The move toward natural gas has been going on for years, but consumers are now also demanding silent generators, generators that can be monitored remotely by phone, and inverters. PSR

Tyler Wiegert is a Project Manager at Power Systems Research (PSR), a market research and consulting company based in St. Paul, MN